Introduction

In every business, the flow of money acts as its lifeblood, essential for sustaining operations and fueling growth. At the heart of managing this vital flow is the Accounts Receivable Clerk, a key player whose meticulous efforts ensure that invoices turn into actual income, keeping the company’s financial health robust. Understanding what accounts receivable involves is more than about knowing it’s about tracking payments due to a company; it’s about grasping how these professionals maintain the delicate balance of incoming cash that supports all parts of a business.

Employers seeking the ultimate job description template for an Accounts Receivable Clerk need look no further. By accessing the document provided below, you’ll gain complimentary access to a meticulously crafted job description template that embodies the core principles and best practices of C9Staff’s renowned hiring methodology. This template serves as an exceptional foundation for developing your own customized hiring specifications, ensuring you attract and identify the most qualified candidates efficiently. Simply download your free template today and start building your ideal team with precision.

Accounts Receivable Clerk Job Description Template

For employers, crafting a precise and detailed job description for this role is not just administrative—it’s strategic. The right description attracts the right candidate, someone who not only fits the role technically but also aligns with the company’s culture and goals. For job seekers, a well-defined job description serves as a crucial tool in evaluating potential job fits, highlighting necessary skills and qualifications they need to meet or aspire to. Thus, clear and comprehensive job descriptions are fundamental, serving as a bridge connecting the most qualified candidates with the roles that need them.

This guide, promises to deepen your understanding of this pivotal position. Whether you are drafting your next job listing or tailoring your resume for your dream role in finance, this article will equip you with knowledge and insights that enhance your ability to excel. Get ready to dive into the essentials of what makes an effective accounts receivable clerk and how mastering this information can significantly boost your career or company. Engage with us to transform a standard job description into a powerful tool for success.

Unlocking the Role: Inside the Day-to-Day of an Accounts Receivable Clerk

Understanding the Role of an Accounts Receivable Clerk

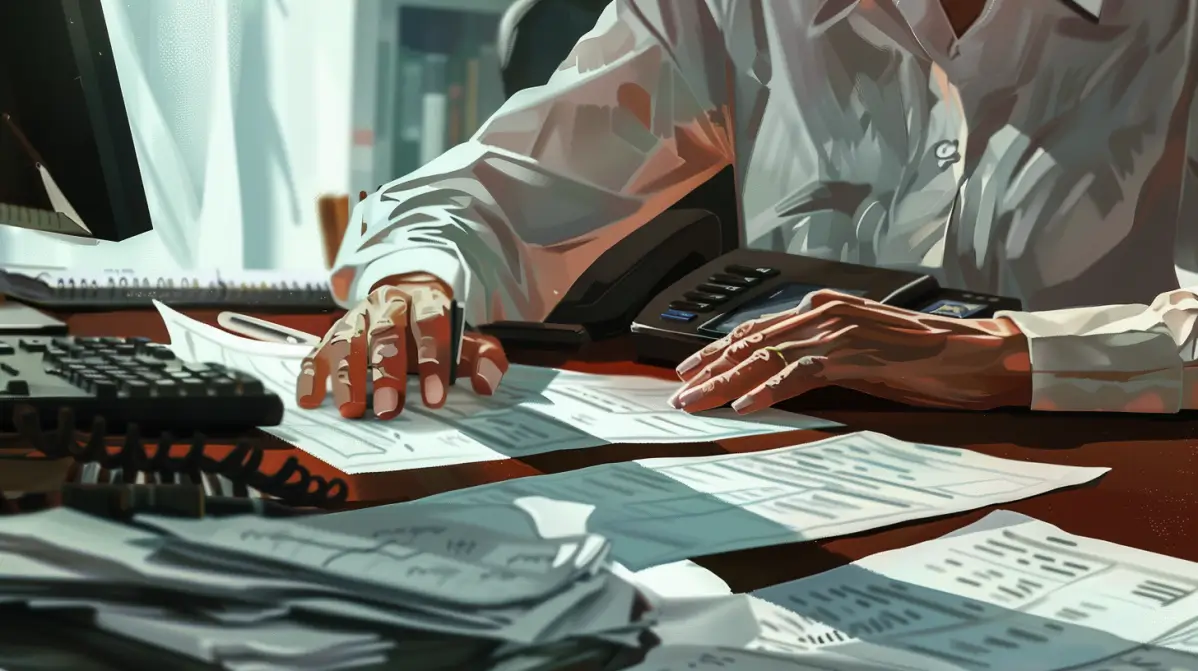

The role of an Accounts Receivable Clerk is pivotal in any business, ensuring the steady flow of cash that powers every aspect of operations. If you’re an employer looking to hire or a job seeker considering this critical position, understanding the daily responsibilities and required skills of an accounts receivable clerk is crucial.

Primary Responsibilities and Daily Tasks

An Accounts Receivable Clerk acts as the linchpin in the financial chain of your business, primarily responsible for the timely receipt of funds. Daily tasks include managing incoming payments, maintaining detailed and accurate records of transactions, following up on outstanding invoices, and preparing financial reports that reflect the status of accounts. These responsibilities ensure that your business has a clear, up-to-date picture of its financial health, enabling better decision-making and strategic planning.

Essential Skills for Success

To excel as an Accounts Receivable Clerk, certain skills are paramount:

- Attention to Detail: The ability to catch discrepancies at a glance and maintain precise accuracy in all figures is non-negotiable. Every penny must be accounted for, as even the smallest error can lead to significant financial discrepancies.

- Proficiency in Accounting Software: Familiarity with accounting platforms such as QuickBooks, Sage, or Oracle Financials is essential. These tools are integral to managing accounts and streamlining financial operations.

- Strong Communication Skills: Both written and verbal communication skills are crucial. You must effectively coordinate with clients and internal teams, negotiate with delinquent accounts, and present reports to management. Clear communication helps in resolving payment issues swiftly and maintaining professional relationships.

These core skills enable an Accounts Receivable Clerk to manage tasks efficiently and uphold the financial integrity of the business.

Impact on Financial Health and Cash Flow

The role of an Accounts Receivable Clerk is more than just administrative; it is fundamentally linked to the financial pulse of the company. By ensuring that payments are received and processed in a timely manner, you help maintain the necessary cash flow to meet the company’s operational needs. This includes paying employees, fulfilling customer orders, and investing in business growth. Furthermore, effective management of accounts receivable helps in quick debt recovery, which in turn minimizes the risk of bad debts that can severely impact the company’s profitability and financial sustainability.

Mastering Payments: 5 Essential Tips Every Accounts Receivable Clerk Needs to Know

Crafting the Perfect Job Description (Employers)

In the competitive arena of digital innovation, the allure of a job description can be the difference between attracting just another candidate and securing a visionary UI/UX designer who will propel your company into the future. Crafting this beacon begins with understanding the anatomy of an exceptional job description, a task that requires more than just listing requirements; it demands storytelling that resonates with the ambitions and talents of the best in the field.

Examples of Compelling Job Descriptions

When drafting a job description for an Accounts Receivable Clerk, your primary aim is to create a document that is not only clear and comprehensive but also compelling enough to attract top-tier candidates. Here’s how you can craft a job description that stands out and effectively communicates the role’s requirements, ensuring that it resonates with the best in the field.

Essential Components of a Great Job Description

Job Title

Start with a precise job title. “Accounts Receivable Clerk” is standard, but consider nuances based on your organization’s specific needs. For example, “Accounts Receivable Specialist” if the role demands specialized knowledge or experience.

Summary

This section should provide a brief overview of the role in your company. Aim for a concise description that highlights the importance of the position within your financial department. Mention how this role contributes to the overall financial health and stability of the company.

Responsibilities

Detail the specific tasks expected of the role. Include daily activities such as tracking and reconciling invoice payments, handling missed payments, and preparing financial reports. Clearly state how these tasks impact the broader business objectives, such as maintaining cash flow and financial accuracy.

Qualifications

List essential and preferred qualifications, distinguishing between the two. This may include a minimum education requirement, necessary certifications (e.g., CPA), and experience with specific accounting software. Highlight soft skills such as attention to detail, problem-solving abilities, and communication skills that are crucial for success in this role.

Benefits

Outline the benefits associated with the role. Beyond health and retirement plans, mention any company-specific perks like flexible working conditions, professional development opportunities, or wellness programs. This section is vital in painting a picture of a rewarding work environment that values its employees.

Attracting Top Talent

To attract highly qualified candidates, the language and presentation of your job description must be meticulously crafted:

- Engaging Language: Use dynamic and engaging language that speaks directly to candidates, making them feel that they are exactly who you’ve been looking for. Use phrases like “Join our innovative team” or “Elevate your career with us” to evoke excitement about the opportunities the role offers.

- Highlight Growth Opportunities: Top talent is often looking for more than just a job; they want a career path. Highlight any potential for advancement or ongoing professional development within your organization.

- Emphasize Cultural Fit: Briefly touch upon the company culture and how it supports and enhances the work life of your employees. Candidates who resonate with your company’s values are more likely to be engaged and committed in the long term.

Compliance and Clarity

Ensuring that your job description is not only attractive but also legally compliant is crucial:

- Avoid Discriminatory Language: Be conscious of discrimination laws related to hiring. Ensure that your job description is inclusive and free from any language that could be construed as discriminatory based on age, gender, race, ethnicity, or disability.

- Clarity: Be as clear as possible about the role’s requirements and responsibilities to avoid future misunderstandings. Ensure that every part of the job description is easy to understand and leaves no room for ambiguity.

- Legal Requirements: Familiarize yourself with the legal standards in your region concerning job descriptions and employment practices. This might include specific declarations about the handling of personal data or adherence to workplace safety laws.

By following these guidelines, you create a job description that not only fulfills legal obligations but also serves as a key tool in attracting the best talent to your organization. Remember, a well-crafted job description is the first step in a successful recruitment process, setting the stage for hiring an Accounts Receivable Clerk who will contribute significantly to the financial efficacy and culture of your company.

Employers seeking the ultimate job description template for an Accounts Receivable Clerk need look no further. By accessing the document provided below, you’ll gain complimentary access to a meticulously crafted job description template that embodies the core principles and best practices of C9Staff’s renowned hiring methodology. This template serves as an exceptional foundation for developing your own customized hiring specifications, ensuring you attract and identify the most qualified candidates efficiently. Simply download your free template today and start building your ideal team with precision.

Accounts Receivable Clerk Job Description Template

Decoding the Job Description (Job Candidates)

Navigating the job market can be daunting, especially when you’re trying to decode the often-cryptic language of job postings. As a job seeker aiming for a position as an Accounts Receivable Clerk, understanding how to read between the lines of a job description can be your first step toward landing an interview. This section will guide you through interpreting job descriptions, matching your skills to the requirements, and tailoring your application to make a memorable impact.

Reading Between the Lines

Job postings are more than just a list of duties and requirements—they are a snapshot of the company’s needs and culture. When you read a job description, look for keywords and phrases that indicate what the company values most. For example, terms like “fast-paced environment” suggest a need for efficiency and the ability to handle stress, whereas “detail-oriented” highlights an emphasis on precision and thoroughness.

Beyond the obvious, try to grasp the subtler demands of the role. If a posting emphasizes “team collaboration,” it’s not just about working with others but also about possessing strong interpersonal skills and a cooperative spirit. These insights help you understand the company’s culture and whether it aligns with your work style and values.

Matching Skills to Requirements

Once you’ve interpreted the job description, it’s time to assess how well your skills and experiences align with the role. Start by listing your hard skills, such as proficiency in accounting software like QuickBooks or Oracle Financials, which are often non-negotiable requirements. Then, consider your soft skills—perhaps your strong communication abilities or organizational prowess. These are equally important as they often determine how well you’ll integrate into the company’s existing processes and culture.

Evaluate your match by:

- Creating a checklist of the job’s requirements and ticking off those you meet.

- Identifying gaps in your skills that may need addressing or highlighting how you plan to bridge these in your application or interview.

- Considering examples from past roles where you’ve demonstrated these skills, preparing to discuss these during interviews or mention them in your application.

Preparing Your Application

Crafting a tailored application is crucial. Your resume and cover letter should mirror the language and requirements of the job posting to show that you are not only a qualified candidate but also one who has done their homework.

- Customize your resume: Align your resume’s skills and experience sections with the keywords and competencies outlined in the job description. Use similar language and phrasing to make it clear that your experience directly relates to the job requirements.

- Craft a targeted cover letter: Your cover letter should address specific points in the job description. Connect your background to the role by discussing relevant experiences and explaining how they make you an ideal candidate.

- Highlight your value: Demonstrate how you can add value to the company based on the duties and expectations mentioned in the job description. For instance, if the role requires handling high volumes of transactions, describe how your organizational skills and attention to detail have positively impacted previous employers.

By meticulously aligning your application materials with the job description, you not only increase your chances of passing through automated resume filters but also prove to hiring managers that you are attentive and proactive.

Are you ready to supercharge your career and land your dream job? At C9Staff, we specialize in connecting talented individuals with outstanding opportunities that align with their career aspirations. We invite you to click the link below and submit your resume to our talent acquisition department. If your qualifications meet our clients’ requirements, we will promptly contact you to discuss potential opportunities tailored to your skills and experiences. Don’t miss out—submit your resume today and take the first step towards a transformative career move with C9Staff.

Industry Standards and Salary Information

In the evolving landscape of financial roles, Accounts Receivable Clerks remain pivotal in managing the inflows that sustain business operations. Understanding the compensation, career paths, and emerging industry trends is essential whether you are entering the field or aiming to advance your career.

Salary Ranges

The salary for Accounts Receivable Clerks can vary significantly based on geographic location, industry, and the level of experience. Nationally, the average salary for Accounts Receivable Clerks ranges from approximately $35,000 to $45,000 annually, according to the latest data from the U.S. Bureau of Labor Statistics. In high-cost living areas or financial hubs such as New York or San Francisco, salaries can peak considerably higher, reflecting the regional cost of living and competitive markets. Furthermore, sectors like technology and healthcare tend to offer higher pay scales, recognizing the specialized billing protocols and financial management needs intrinsic to these industries.

Career Progression

Starting as an Accounts Receivable Clerk opens a variety of pathways for professional growth. With experience, clerks can aspire to positions such as Accounts Receivable Manager, Credit Manager, or even Controller. Each step up typically requires additional skills and qualifications, such as expertise in specific financial software, advanced accounting knowledge, or a Certified Public Accountant (CPA) license. Furthermore, clerks who exhibit strong analytical skills and a strategic mindset often transition into roles that influence business decisions at higher management levels. Continuing education and professional certifications can significantly bolster one’s trajectory, facilitating transitions into more complex and higher-paying roles.

Recent Trends

The role of the Accounts Receivable Clerk is dynamically changing, influenced heavily by technological advancements and shifting business practices. Automation and AI are streamlining transaction processing, reducing the manual workload and emphasizing the need for clerks to manage more analytical tasks such as interpreting financial data and improving cash flow strategies. Mastery of new financial software and tools that leverage machine learning for predictive analysis is becoming increasingly valuable.

Additionally, the rise of remote work has reshaped many traditional office roles, including those in accounts receivable. This shift demands clerks to be more proactive and self-directed, capable of managing responsibilities without direct supervision. Adapting to these new models requires not only technical skills but also strong communication abilities and time management.

Navigating your career as an Accounts Receivable Clerk means staying informed about these trends and adapting to new opportunities as they arise. Whether you’re just starting out or seeking advancement, equipping yourself with the latest knowledge and skills will ensure you remain competitive and relevant in this essential financial role. By embracing both the challenges and opportunities these changes present, you’ll be well-positioned to succeed and advance within the financial domain.

Employers looking to optimize their recruitment process for an Accounts Receivable Clerk are invited to explore the comprehensive services offered by C9Staff. By scheduling a free exploratory call with one of our experienced account managers, you’ll discover how we can assist you in sourcing, recruiting, hiring, training, managing, and deploying the ideal candidate for your organization. During this call, we’ll attentively listen to your needs and provide endorsements for potential candidates at no cost, helping you evaluate the best talent available at competitive prices. Click the link below to schedule your consultation today and take the first step towards enhancing your team with top-tier talent.

Conclusion

Throughout this guide, we’ve explored the critical elements that define the role of an Accounts Receivable Clerk and how understanding these can significantly enhance recruitment and career progression. For employers, creating a detailed and precise job description is not just about filling a vacancy but about attracting the most suitable candidates who can contribute to the financial robustness of your organization. For job seekers, a well-understood job description serves as a roadmap to tailoring your skills and presenting yourself as the ideal candidate, aligned perfectly with the role’s demands.

Employers and job candidates alike, take these insights and apply them to refine your hiring strategies and job search techniques. By fully gravitating the distinctions of the Accounts Receivable Clerk’s responsibilities and the evolving industry standards, you position yourselves to meet and exceed professional expectations. Harness the power of a thorough job description and leverage it to secure top talent and coveted positions.

Let this guide serve as your foundation in mastering the roles within accounts receivable. Whether you are on the hiring side or the hopeful candidate, let the knowledge you’ve gained here propel you forward. Take confident steps towards building or enhancing a career in this vital sector, equipped with the best practices and insights to succeed. Remember, the path to professional excellence is paved with continual learning and proactive adaptation.