Introduction

Blockchain technology has revolutionized industries, offering unparalleled transparency, security, and efficiency. However, with great innovation comes great responsibility—especially when it comes to compliance. Navigating the intricate maze of regulations around blockchain, such as anti-money laundering (AML) standards, data protection laws, and financial regulations, is no small feat.

For companies leveraging blockchain, compliance costs can quickly spiral out of control. Building in-house teams, staying updated with evolving laws, and mitigating risks demand significant time, expertise, and financial investment. This is where outsourcing blockchain compliance emerges as a game-changing strategy—an efficient way to balance innovation with regulatory adherence while keeping costs in check.

Why Blockchain Compliance Is So Complex

Blockchain’s decentralized nature makes it both powerful and challenging. Unlike traditional systems, where centralized control simplifies oversight, blockchain relies on distributed nodes, making it harder to pinpoint accountability and ensure adherence to legal frameworks.

Key compliance challenges include:

Evolving Regulations:

Blockchain laws vary widely across jurisdictions and are constantly changing. For example, the European Union’s General Data Protection Regulation (GDPR) clashes with blockchain’s immutable ledgers by demanding data erasure rights.

Anti-Money Laundering (AML) Requirements:

Blockchain’s potential for pseudonymous transactions raises red flags for regulators. Ensuring compliance with AML and Know Your Customer (KYC) standards is critical but resource-intensive.

Financial Oversight:

Cryptocurrencies and tokenized assets are subject to scrutiny by financial authorities. Companies must ensure compliance with securities laws, tax regulations, and reporting requirements.

Cybersecurity Risks:

Blockchain compliance isn’t limited to legalities; protecting data and infrastructure from breaches is equally important.

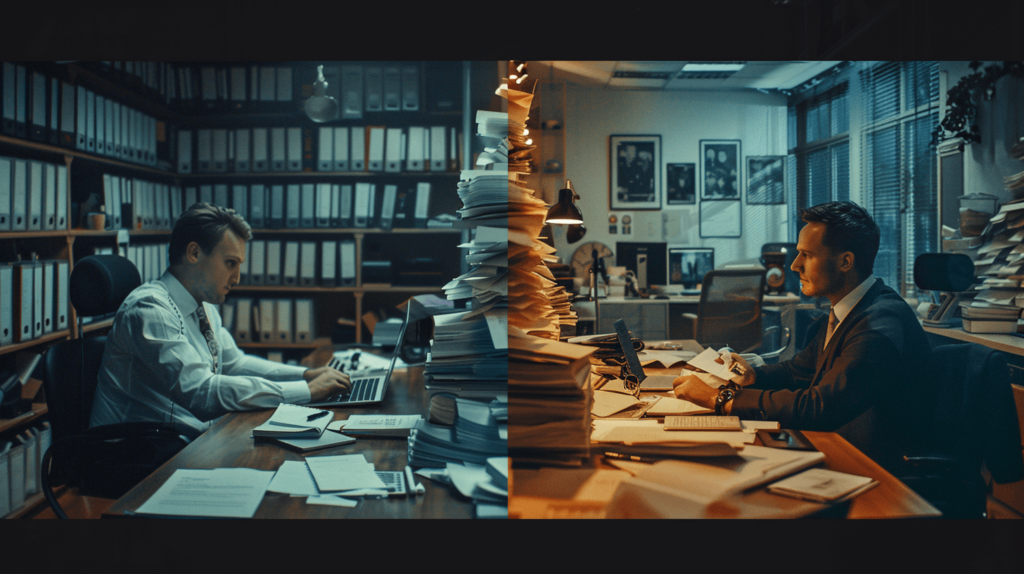

Meeting these challenges in-house requires hiring skilled professionals, implementing advanced systems, and dedicating ongoing resources—all of which can strain budgets, especially for startups and small-to-medium enterprises (SMEs).

The Outsourcing Solution for Blockchain Compliance

Outsourcing blockchain compliance is gaining traction as a smart alternative. By partnering with external specialists, companies can reduce costs, access expertise, and remain focused on their core operations. Outsourcing shifts the burden of compliance to trusted providers with the knowledge and tools to navigate regulatory landscapes effectively.

Benefits of Outsourcing Blockchain Compliance

Significant Cost Savings:

Compliance isn’t cheap. Recruiting a full-time team of blockchain experts, lawyers, and IT professionals can cost millions annually. Outsourcing eliminates these overheads, allowing businesses to pay only for the services they need.

Example: A blockchain startup in the fintech space saved 40% on compliance costs by outsourcing AML and KYC processes to a specialized firm.

Access to Specialized Expertise:

Compliance firms are staffed with professionals who are experts in blockchain regulations, cybersecurity, and global standards. They stay up-to-date with the latest changes, ensuring businesses don’t fall behind.

Scalability and Flexibility:

Outsourcing partners can scale their services based on your needs. Whether you’re launching an Initial Coin Offering (ICO) or expanding to new markets, they can adapt quickly without requiring you to restructure your internal teams.

Risk Reduction:

By leveraging external expertise, you can proactively identify and address compliance risks, avoiding hefty fines, reputational damage, and operational disruptions.

Example: A gaming company using blockchain reduced the risk of regulatory penalties by outsourcing their compliance audits to a firm specializing in blockchain law.

Time Efficiency:

Building internal compliance systems from scratch takes months or even years. Outsourcing allows businesses to hit the ground running, focusing on innovation and growth instead of regulatory red tape.

How Outsourcing Works in Practice

Outsourcing blockchain compliance typically involves the following steps:

Assessment of Compliance Needs:

The outsourcing provider conducts an in-depth review of your business operations, identifying regulatory gaps and risks.

Tailored Solutions:

A compliance strategy is crafted to address your specific needs, whether it’s adhering to AML laws, implementing cybersecurity measures, or managing data privacy.

Integration with Existing Systems:

The provider ensures seamless integration of compliance tools with your blockchain platforms, minimizing disruption to operations.

Ongoing Monitoring and Reporting:

Continuous audits, updates, and reporting ensure compliance with ever-changing regulations. For example, a provider might use AI-driven monitoring tools to flag suspicious transactions in real time.

Outsourcing firms often employ a mix of manual expertise and automated systems, creating a robust and cost-effective compliance infrastructure.

Choosing the Right Outsourcing Partner

The success of outsourcing blockchain compliance hinges on selecting the right partner. Not all providers are created equal, and the wrong choice can leave your business exposed to risk. Here’s how to ensure you find the perfect fit:

Expertise in Blockchain Compliance

Look for firms with a proven track record in blockchain-specific regulations. They should have deep knowledge of areas such as anti-money laundering (AML), General Data Protection Regulation (GDPR), and financial reporting standards.

Example: A fintech startup partnered with a firm specializing in cryptocurrency compliance, which helped them navigate complex AML laws, saving them from potential fines.

Technological Capability

The best partners leverage advanced tools, such as artificial intelligence (AI) and machine learning, to automate compliance monitoring, flag risks, and ensure real-time adherence. These capabilities reduce human error and increase efficiency.

Scalability and Flexibility

Choose a partner capable of scaling services as your business grows. Whether you’re launching a new blockchain product or expanding internationally, your compliance provider should adapt to your evolving needs.

Transparent Pricing Models

Ensure the provider offers clear, upfront pricing with no hidden fees. This transparency helps you accurately budget and understand your cost savings.

References and Reviews

Check client testimonials, case studies, and independent reviews to assess the firm’s reputation. A provider with glowing feedback is more likely to deliver exceptional results.

Steps to Seamlessly Implement Outsourced Blockchain Compliance

Transitioning to an outsourced model requires careful planning and execution to ensure smooth integration. Follow these steps for success:

Define Your Goals

Clearly outline your compliance objectives. Are you focusing on reducing costs, mitigating risks, or scaling operations? Understanding your priorities will guide your partnership.

Conduct a Risk Assessment

Collaborate with your provider to identify vulnerabilities in your current compliance framework. A thorough assessment ensures all potential risks are addressed upfront.

Customize Your Strategy

Work closely with the outsourcing firm to develop a tailored compliance plan. This should include automated monitoring tools, manual audits, and staff training to align with your organization’s needs.

Integrate with Existing Systems

Ensure the provider’s solutions integrate seamlessly with your blockchain infrastructure. For example, if you’re running a decentralized finance (DeFi) platform, the compliance tools must sync with your smart contract ecosystem.

Monitor and Evaluate

Regularly review performance metrics and feedback from your provider. This ongoing evaluation ensures the compliance framework remains effective as regulations evolve.

Success Stories: Real-World Impact of Outsourcing

Outsourcing blockchain compliance isn’t just theoretical—it’s transforming businesses worldwide. Here are a few examples that showcase its effectiveness:

A Cryptocurrency Exchange Navigates Global Regulations

A mid-sized crypto exchange operating across multiple jurisdictions struggled to keep pace with varying AML and KYC requirements. By outsourcing compliance, they implemented a centralized system that automated identity verification and transaction monitoring, reducing costs by 50% while maintaining full regulatory compliance.

A Blockchain Gaming Startup Avoids Costly Penalties

A gaming platform using blockchain to issue NFTs faced scrutiny over tax reporting and intellectual property compliance. Partnering with a specialized firm, they identified and resolved gaps in their framework, avoiding hefty fines and building trust with users.

A DeFi Project Gains Investor Confidence

A decentralized finance (DeFi) protocol aimed to attract institutional investors but faced skepticism over its regulatory readiness. By outsourcing compliance audits and certifications, the project demonstrated its commitment to transparency, securing $10 million in funding.

The Hidden Cost of Not Outsourcing

Failing to address blockchain compliance effectively can lead to severe consequences, including:

Regulatory Fines:

Non-compliance can result in penalties that far outweigh the cost of outsourcing. For instance, GDPR violations can lead to fines of up to €20 million or 4% of global revenue.

Reputational Damage:

Regulatory breaches erode trust with customers, investors, and partners, impacting long-term growth.

Operational Disruptions:

Addressing compliance issues retroactively often leads to costly downtime and resource diversion, hindering innovation.

Outsourcing mitigates these risks by ensuring your compliance framework is proactive, robust, and continually optimized.

Key Industries Benefiting from Blockchain Compliance Outsourcing

Certain industries are particularly well-positioned to gain from outsourced compliance services:

Financial Services: Banks, payment processors, and crypto exchanges face stringent AML and KYC requirements. Outsourcing ensures adherence while reducing operational complexity.

Healthcare: Blockchain applications in healthcare must comply with data privacy laws like HIPAA. External providers offer the expertise needed to manage sensitive patient data securely.

Supply Chain Management: Companies using blockchain for traceability can outsource compliance to navigate international trade regulations effortlessly.

Conclusion: Embrace the Future of Compliance

Outsourcing blockchain compliance isn’t just a cost-saving measure—it’s a strategic enabler of growth and innovation. By partnering with experts, businesses can navigate complex regulatory landscapes with confidence, focus on their core operations, and scale efficiently.

As blockchain technology continues to evolve, so will the compliance requirements that come with it. By outsourcing, you’re not just managing today’s challenges—you’re future-proofing your operations for the opportunities of tomorrow.