Introduction

In the heart of every thriving business is a figure often unseen yet indispensable—the bookkeeper. As a business owner, every decision you make, from monumental investments to the minutest financial details, hinges on the accuracy and clarity provided by this crucial role. Imagine your enterprise as a complex machine: your bookkeeper is the one ensuring all gears—revenues, expenses, and financial reports—are well-oiled and functioning seamlessly. This meticulous oversight is what sustains your business’s financial health and empowers you to make strategic decisions with confidence.

If your primary goal as an employer is to secure the best job description template available—a foundational tool for crafting your own comprehensive hiring specifications—then look no further. Click the link below for a direct download of our complimentary Bookkeeper Job Description template. This expertly crafted document embodies the core principles and best practices of C9Staff’s renowned hiring methodology, ensuring you start your recruitment process on the strongest footing possible. Equip yourself with a tool designed to attract top talent and streamline your hiring process effectively.

Bokkeeper Job description template

In this comprehensive guide, you will delve into the world of bookkeeping. You’ll gain a thorough understanding of what bookkeepers do, the essential skills required to excel in this role, the various career paths that are available, and how savvy employers can craft compelling job descriptions to attract the finest candidates. Whether you’re a potential bookkeeper looking to enter the field or an employer eager to enhance your team, this article is tailored to provide you with deep insights and practical advice.

Moreover, this guide emphasizes the significance of appreciating both perspectives—that of candidates aspiring to become bookkeepers and of employers aiming to hire them. Understanding these viewpoints will not only aid candidates in shaping their career paths to meet current market demands but also assist employers in creating offers that are both appealing and competitive. By the end of this introduction, you’ll be equipped with a deeper appreciation of how bookkeepers contribute to the success of any business, often quietly but always critically.

Embark on this exploration with us, as we reveal the nuances of a bookkeeper’s role and how integral they truly are to any business’s success. Let this journey enrich your understanding and enhance your actions, whether you’re steering your career or steering your company forward.

Mastering the Fundamentals: 7 Essential Steps to Kickstart Your Bookkeeping Journey

What Does a Bookkeeper Do?

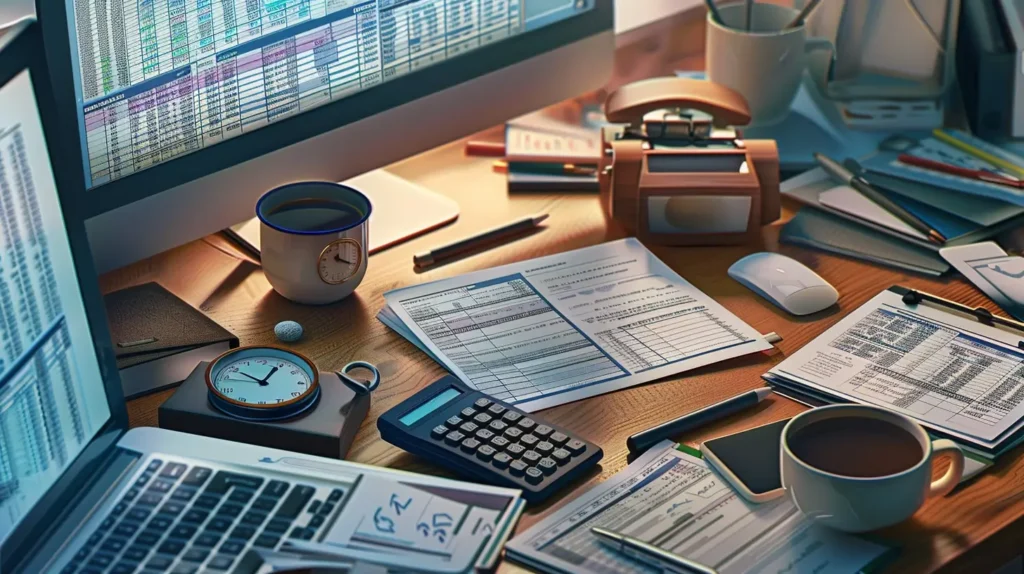

Imagine you are stepping into the realm of bookkeeping—a field where precision meets fiscal responsibility. In any business, big or small, bookkeepers play a pivotal role, quietly but crucially maintaining the financial health of the enterprise. They are the unsung heroes behind the scenes, making sure that every dollar is accounted for, every budget line is correct, and every financial statement is immaculate. Their meticulous work not only ensures compliance with various financial regulations but also provides the groundwork for strategic business decisions.

Core Duties of a Bookkeeper

Maintaining Financial Records: At the heart of a bookkeeper’s responsibilities is the maintenance of accurate financial records. This involves recording all financial transactions, posting debits and credits, producing invoices, and managing payroll. Each transaction must be documented in a way that aligns with both company policies and legal requirements.

Managing Budgets: Bookkeepers often assist in budget preparation and management. This involves monitoring company spending and reporting back on variances between the budgeted and actual expenditures, which helps management adjust their financial strategies accordingly.

Handling Payroll: They ensure that all employees are paid accurately and on time. This includes calculating pay and deductions, issuing checks or processing direct deposits, and managing benefits.

Tools and Software

To accomplish these tasks efficiently, bookkeepers rely on a variety of tools and software. Applications like QuickBooks, Xero, and Sage are staples in this field, automating many of the tedious tasks associated with bookkeeping. These tools help bookkeepers maintain accurate records, reconcile accounts faster, and provide detailed reports that aid in financial planning and audits.

A Day in the Life of a Bookkeeper

Let’s walk through a typical day for a bookkeeper:

Morning: The day starts with checking emails and messages for any urgent requests or updates from colleagues. This is followed by a review of transactions from the previous day, ensuring that all entries are correct and that no discrepancies are present.

Midday: Focus shifts to preparing invoices for clients and processing any incoming payments. This is also the time to handle payroll issues, such as adjusting for overtime or processing expense reimbursements.

Afternoon: In the later part of the day, the bookkeeper might meet with management to discuss budgetary concerns or upcoming financial reports. The rest of the afternoon is spent updating financial records with the day’s transactions and preparing for the next day.

Evening: Before wrapping up, a final check ensures that all financial data is synced and backed up. Any pending tasks are noted, setting the stage for the next day’s work.

Through these activities, the bookkeeper sustains the financial workflow of the business, ensuring that every financial aspect is tightly controlled and accurately reflected

Streamline Your Success: 8 Top Bookkeeping Tips for Small Business Mastery

Essential Skills and Qualifications

As you either contemplate a career as a bookkeeper or are in the process of hiring one, comprehending the essential skills and qualifications required is vital. This section explores the technical skills needed for bookkeeping, the soft skills that complement these technicalities, and the educational paths and certifications that can enhance career prospects. By understanding these, you can better gauge what it takes to succeed in the field or identify the ideal candidate for your business needs.

Technical Skills

Proficiency in Accounting Software:

In the digital age, proficiency in accounting software such as QuickBooks, Xero, or Sage is indispensable. These tools are central to maintaining accurate financial records and streamlining financial processes. For instance, QuickBooks allows for efficient tracking of sales, expenses, and transactions, which aids in comprehensive financial reporting. Mastery of these tools not only increases efficiency but also minimizes errors that could potentially lead to financial discrepancies.

Data Entry and Numerical Accuracy:

The bedrock of bookkeeping lies in the accuracy of data entry. Precision in entering data ensures that financial records reflect true and fair views of the business’s financial status. This skill is crucial as even minor errors can lead to significant financial misstatements. For example, accurately inputting payroll data affects everything from salary payments to tax deductions, directly impacting an organization’s operational efficiency.

Soft Skills

Communication:

Effective communication is essential for bookkeepers, who must often explain complex financial information in an understandable way to management, colleagues, and sometimes clients. Whether it’s clarifying a financial report’s implications or discussing budget forecasts, the ability to convey information clearly and effectively ensures smooth operations across departments.

Organization:

A high level of organization enables a bookkeeper to manage various financial tasks efficiently. This skill is necessary for juggling multiple deadlines, such as monthly close processes or regular financial audits, and ensuring all financial documentation is systematic and easily accessible.

Ethical Integrity:

Ethics in bookkeeping cannot be overstated. Bookkeepers handle sensitive financial information and must uphold the utmost integrity, ensuring confidentiality, honesty, and accuracy in their work. For example, adhering to ethical standards is critical when managing funds or reporting financial data, as stakeholders rely on their transparency and truthfulness.

Educational and Certification Requirements

Educational Pathways:

Typically, bookkeepers have a background in accounting or business studies, with many possessing at least an associate’s degree in related fields. This educational foundation provides them with basic accounting principles and business practices needed to perform their duties effectively.

Certifications:

Gaining certifications, such as the Certified Bookkeeper (CB) designation from recognized professional bodies, can significantly enhance a bookkeeper’s credibility and career prospects. These certifications validate a bookkeeper’s skills and knowledge, making them more attractive to potential employers and often leading to better job opportunities and higher salaries.

Navigating Your Career Path as a Bookkeeper

As you embark on or continue your journey in the field of bookkeeping, understanding the myriad career progression opportunities and the importance of continual education is crucial. Whether you are just starting out or seeking to advance further, this section will guide you through the landscape of professional growth and development opportunities that can elevate your career in bookkeeping.

Career Progression

The journey of a bookkeeper can vary widely but typically starts at entry-level positions where the fundamental tasks of financial recording and data management are mastered. As you gain experience, opportunities to ascend to senior roles such as Senior Bookkeeper, Lead Accountant, or even Financial Controller become available. Real-world examples include John Doe, who began as a junior bookkeeper at a small firm and rose to become the Chief Financial Officer (CFO) of a well-known corporation by consistently enhancing his skills and embracing every learning opportunity.

Specialization within bookkeeping offers additional career doors. For instance, specializing in payroll can lead you to become a Payroll Manager, while expertise in receivables might pave the way to a Credit Manager position. Some bookkeepers extend their skills to niche areas like forensic bookkeeping, which often leads to consultancy roles or specialized managerial positions.

Continued Education

In the rapidly evolving world of finance, staying updated with the latest accounting software, understanding new financial regulations, and adopting advanced bookkeeping practices are essential. Engaging in ongoing education not only enhances your efficiency but also significantly boosts your marketability and adaptability in various industries.

Educational pathways for bookkeepers include a range of online courses, workshops, and seminars tailored to keep you at the forefront of accounting technology and standards. Certifications play a pivotal role in your career development. The Certified Bookkeeper (CB) designation from the American Institute of Professional Bookkeepers and the Certified Public Bookkeeper (CPB) license are benchmarks of professional competence that can dramatically improve your career prospects. These certifications validate your skills and knowledge, providing you with a competitive edge in the job market.

For Employers: Crafting the Perfect Bookkeeper Job Description

As an employer or HR manager, recruiting a competent bookkeeper is crucial not only for managing your company’s accounts efficiently but also for contributing to its overall financial health. This section provides a step-by-step guide on crafting a job description that is clear, comprehensive, appealing, and inclusive, designed to attract the best candidates in the field.

Key Components of a Job Description

Clear Job Title:

Start by emphasizing the importance of a precise job title that accurately reflects the role and responsibilities. A well-defined job title sets the tone and expectations for potential applicants, helping to attract those most suited for the position. For instance, specifying whether the role is for a “Junior Bookkeeper” or a “Senior Bookkeeper” immediately clarifies the level of expertise required.

Detailed Responsibilities:

Detailing the responsibilities and daily tasks is essential. This clarity helps candidates understand the scope of the role and assess whether their skills align with your needs. Include specific tasks such as maintaining financial records, handling payroll, and preparing tax returns. This transparency not only helps in attracting the right candidates but also reduces the likelihood of misunderstandings later in their tenure.

Attracting the Right Candidates

Inclusive and Appealing Language:

To attract a diverse pool of candidates, use language that is inclusive and reflects your company’s values. Highlight your organization’s commitment to diversity and inclusion. Mention any specific initiatives or policies that support a broad spectrum of employees.

Emphasize Benefits and Growth Opportunities:

Candidates are often looking for more than just a paycheck. Highlighting benefits, growth opportunities, and work-life balance can make the position more attractive. Detail aspects like flexible working hours, professional development programs, and health benefits, which can set your job offer apart from others.

Legal Considerations:

It’s crucial to ensure that your job description complies with employment laws. This includes using non-discriminatory language and providing an accurate representation of the job’s demands and requirements. For instance, ensure that the qualifications and experiences listed are truly necessary for the job and not just preferable, which could inadvertently screen out capable candidates.

If your primary goal as an employer is to secure the best job description template available—a foundational tool for crafting your own comprehensive hiring specifications—then look no further. Click the link below for a direct download of our complimentary Bookkeeper Job Description template. This expertly crafted document embodies the core principles and best practices of C9Staff’s renowned hiring methodology, ensuring you start your recruitment process on the strongest footing possible. Equip yourself with a tool designed to attract top talent and streamline your hiring process effectively.

Bokkeeper Job description template

Salary Expectations and Industry Trends

Imagine you are a current or aspiring bookkeeper, or perhaps an employer in the finance sector, looking to understand the current and future landscape of bookkeeping. This section is designed to arm you with crucial information about salary expectations across various regions and how emerging industry trends are reshaping the role of bookkeepers. Your task is to present up-to-date data and insightful analysis that helps readers navigate these financial aspects and anticipate future developments in the field.

Current Salary Ranges:

Provide a detailed breakdown of the current salary ranges for bookkeepers, both regionally and nationally. Include factors that influence these figures, such as geographic location, level of experience, and industry sector. Use recent statistics to give the reader a clear picture of what bookkeepers can expect to earn in different parts of the country.

Emerging Trends in Bookkeeping:

Discuss significant trends affecting the bookkeeping landscape, focusing on technological advancements and regulatory changes. For example, explain how the integration of AI and machine learning is automating traditional bookkeeping tasks and what this means for the skill sets required in the future.

Address any recent or upcoming regulatory changes that might impact how bookkeepers operate, emphasizing the need for ongoing education and adaptation.

Your writing should not only inform but also engage the reader by making the data relevant to their personal or professional situation. Use direct language that speaks to the reader as if advising them on their career path or business strategy. This approach will help the section to not only educate but also inspire readers to proactively adapt to a changing economic and technological landscape

If you’re seeking to source, recruit, hire, train, manage, and deploy the ideal bookkeeper for your organization, C9Staff is here to help. Click the link below to schedule a free exploratory call with one of our dedicated account managers today. During this call, we will attentively listen to your specific needs and recommend potential candidates at no cost, helping you assess the best talent available at competitive prices. Don’t miss the opportunity to enhance your team with top-tier bookkeeping professionals tailored to your organizational needs.

Conclusion

As we conclude our in-depth exploration of the bookkeeper’s role, it is essential to reflect on the key insights we’ve discussed, which are pivotal for both aspiring bookkeepers and employers looking to hire top talent. This article has covered a wide range of topics, from the core responsibilities of bookkeepers, including maintaining financial records and overseeing budgets, to the crucial skills and qualifications that underpin success in this field. We’ve also navigated through the career progression opportunities available to bookkeepers and outlined how employers can craft effective and inclusive job descriptions.

We’ve seen that the responsibilities of a bookkeeper are both broad and critically important, requiring a detailed understanding of financial processes and strong organizational skills. For those aspiring to excel in this role, acquiring essential technical skills—such as proficiency in accounting software—and soft skills—like communication and ethical integrity—is non-negotiable. Employers, on the other hand, have learned strategic approaches to crafting job descriptions that not only attract qualified candidates but also align with legal standards and promote an inclusive workplace culture.

For bookkeepers, the path forward involves continuous learning and professional development. Engaging in further education and obtaining certifications like the Certified Bookkeeper designation can significantly enhance your marketability and open up new career opportunities. Employers are encouraged to refine their hiring practices based on the insights shared, ensuring that their job postings not only attract but also retain the best talent by emphasizing benefits, growth opportunities, and a supportive work environment.

As we look to the future, the role of bookkeepers continues to evolve significantly due to technological advancements and regulatory changes. The integration of technologies such as AI and machine learning into accounting processes is not just a trend but a glimpse into the future of bookkeeping. This evolution demands adaptability and foresight from both bookkeepers and employers. Embracing these changes is essential, as they offer incredible opportunities for growth and innovation within the field.

The journey of a bookkeeper in the digital age is one of constant learning and adaptation. As both job candidates and employers, your ability to stay ahead of these changes will define your success in the ever-evolving landscape of bookkeeping. Let this guide serve as a foundation upon which you can build a resilient and forward-looking career or business strategy in bookkeeping. Remember, the future belongs to those who prepare for it today.