Introduction: Understanding the Role of a Compliance Auditor

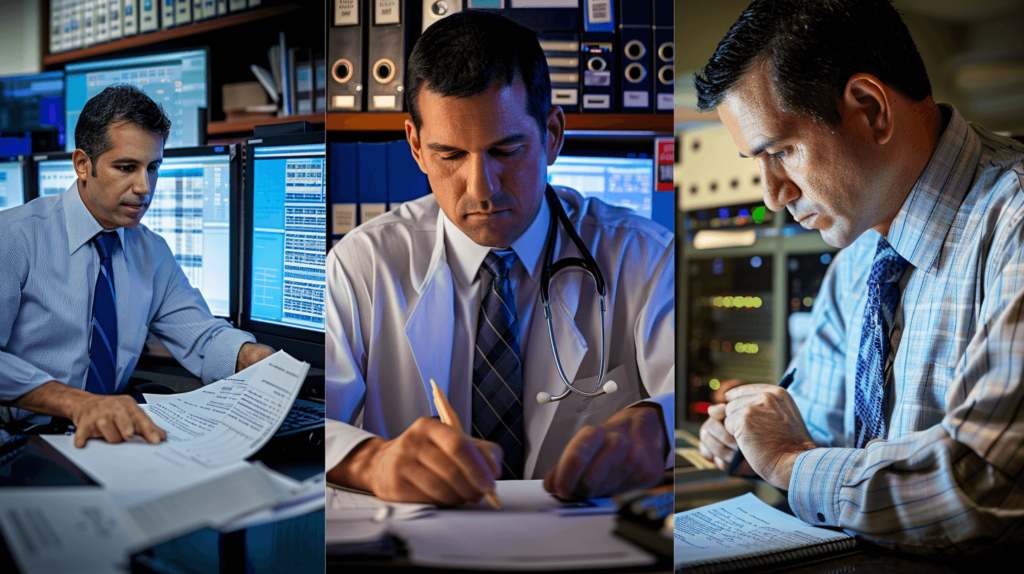

Envision you’re at the helm of a business, navigating through the choppy waters of regulations and laws. Now, consider a Compliance Auditor as your seasoned navigator, ensuring that your journey avoids the legal icebergs that could sink your enterprise. This professional is not just a guardian of rules but a pivotal figure in safeguarding the integrity and success of your business across industries as diverse as finance, healthcare, and government.

If you’re seeking the ultimate job description template for a Compliance Auditor—one that not only meets but exceeds industry standards—look no further. By clicking the link below, you’ll gain complimentary access to our premier job description template. This document is crafted with the precision and expertise characteristic of C9Staff’s renowned hiring methodology. It encapsulates the fundamental principles and best practices essential for recruiting top-tier talent in the field of compliance. Use this template as a robust foundation to tailor your hiring specifications, ensuring you attract and secure the best candidates for your organization.

Compliance Auditor Job Description Template

Download our Free Job Description Template

What exactly does a Compliance Auditor do?

In simple terms, they ensure that an organization adheres to external laws and internal policies. Their role is indispensable in industries heavily regulated by the government, where failing to comply with laws can result in severe penalties, financial loss, and damage to reputation. But their influence extends beyond mere compliance; they foster a culture of integrity and ethical conduct that enhances a company’s standing and operational stability.

Consider a day in the life of a Compliance Auditor in the healthcare sector: they might start their morning reviewing patient data handling procedures at a hospital to ensure it meets HIPAA regulations. By afternoon, they could be leading a training session on the latest updates in healthcare compliance standards. Each task they undertake not only prevents potential legal challenges but also reinforces a framework within which the hospital operates safely and ethically.

The regulatory landscape is ever-changing, with new laws introduced frequently. Here, the Compliance Auditor’s role becomes even more critical—they not only keep the organization up-to-date but also foresee potential compliance challenges. This proactive approach in navigating the complex regulatory environment is crucial for business continuity and growth.

So, as you consider the roles within your organization, remember that a Compliance Auditor is more than a necessity—they are a strategic asset. With their expertise, your business can operate confidently in a legal landscape, turning compliance into a competitive advantage. This introduction is just the beginning; as we delve deeper, you’ll discover how to craft the perfect job description for this key role, ensuring you attract top talent to this critical position. Stay tuned and learn how to harness the full potential of a Compliance Auditor to enhance your company’s compliance and integrity.

Becoming a Compliance Auditor: Your Ultimate Guide with CountyOffice.org

Who Hires a Compliance Auditor: Roles and Responsibilities

As you navigate your career or seek to enhance your organization’s compliance structure, understanding the diverse landscape of employers who rely on Compliance Auditors is key. These professionals are not just a luxury; they are a necessity across multiple sectors, safeguarding the integrity and legality of business operations. From ensuring financial propriety to upholding patient privacy, the roles of Compliance Auditors are as varied as the industries they serve.

Overview of Employers: The demand for Compliance Auditors spans a wide array of settings. Financial institutions rely on them to navigate the complex web of anti-money laundering laws and regulations. Healthcare providers need auditors to ensure strict adherence to HIPAA and other privacy regulations, safeguarding patient information against breaches. Government agencies, too, employ these auditors to oversee and ensure that public institutions comply with overarching legal standards. This strategic placement across sectors underscores their pivotal role in maintaining not just compliance, but also the ethical backbone of organizations.

Sector-Specific Responsibilities: In finance, a Compliance Auditor might spend their days assessing the effectiveness of internal controls or investigating suspicious account activities to prevent fraud. For instance, consider a scenario where an auditor discovers a pattern of irregular transactions that could indicate money laundering. Here, their expertise becomes crucial in initiating appropriate legal actions and refining policies to prevent future violations.

In healthcare, the auditor’s role shifts focus towards protecting patient data and ensuring all practices comply with healthcare laws. A mini-case study could involve an auditor who implements new data protection strategies in a hospital, dramatically reducing the incidences of data leaks and increasing patient trust.

Diversity in the Role: The role of a Compliance Auditor adapts depending on the industry. While anti-money laundering is a priority in finance, in healthcare, the focus might shift to patient privacy and safety regulations. These differences highlight the necessity for tailored job descriptions and targeted training programs, ensuring that auditors are well-prepared for the specific challenges they will face in their particular sectors.

The implications are clear: for job seekers, understanding these diverse roles can guide career specialization decisions. For employers, crafting precise job descriptions tailored to specific industry needs is crucial in attracting the right talent capable of handling distinct challenges.

Engaging with this Information: Imagine you are a hiring manager at a pharmaceutical company or a recent finance graduate aiming to enter the auditing field. Understanding these nuances allows you to tailor your strategies, whether in hiring the right auditor or shaping your career path to meet industry-specific demands.

By familiarizing yourself with the multifaceted roles and responsibilities of Compliance Auditors across various sectors, you not only enhance your professional acumen but also equip your organization or career with a strategic edge in compliance management. Remember, in the world of compliance, knowledge and adaptability are your most valuable assets.

Essential Qualifications and Skills for a Compliance Auditor

In the intricate world of compliance auditing, the difference between adequate and exceptional can hinge on the auditor’s qualifications and skills. This section aims to delineate the critical educational backgrounds, essential certifications, and vital skills—both technical and soft—that a Compliance Auditor must possess to excel. For potential employers, understanding these requirements is key to identifying the ideal candidates who can navigate the complexities of compliance with proficiency.

Education and Certifications

Compliance Auditors typically come from robust educational backgrounds in fields like accounting, law, or finance. A bachelor’s degree in these areas provides the foundational knowledge necessary for understanding the broader legal and financial landscapes. However, certifications play a pivotal role in this profession. The Certified Internal Auditor (CIA) and Certified Information Systems Auditor (CISA) are particularly noteworthy. These certifications are not just accolades; they are essential markers of a professional’s ability to handle the multifaceted nature of compliance tasks. They demonstrate a deep commitment to the field and signify mastery over complex auditing standards and practices. CIAs and CISAs are well-equipped to interpret and apply regulations across a variety of industries, ensuring that organizations adhere to legal frameworks while maintaining operational efficiency.

Technical Skills

The technical skills required for a Compliance Auditor extend beyond general auditing capabilities. These professionals must possess an in-depth understanding of regulatory laws specific to the industry they are monitoring. This includes, but is not limited to, knowledge of financial reporting regulations, anti-money laundering statutes, and data protection laws. Moreover, a Compliance Auditor must be adept at navigating auditing software and tools that enable thorough inspections and reporting. These technical skills are crucial for effectively identifying risks, ensuring regulatory compliance, and providing actionable insights that can prevent or address non-compliance.

Soft Skills

While technical acumen is indispensable, the role of soft skills cannot be overstated. Ethical judgment and critical thinking are at the core of a Compliance Auditor’s skill set. These professionals are often at the front lines of ethical dilemmas and complex decision-making processes. Ethical judgment ensures that auditors maintain integrity and transparency, crucial in building trust within an organization. Critical thinking, on the other hand, allows auditors to analyze and interpret varied data to make informed decisions swiftly and effectively. These soft skills enable Compliance Auditors to navigate the gray areas of compliance, where answers are not always clear-cut but require a balanced and principled approach.

Visual Aid: Checklist of Qualifications and Skills

To aid employers and candidates alike, a visual checklist is provided below. This quick reference encapsulates the core competencies needed for the role, simplifying the process of crafting precise job descriptions and assessing qualifications.

Educational Backgrounds: Degrees in Accounting, Law, or Finance.

Certifications:

Certified Internal Auditor (CIA)

Certified Information Systems Auditor (CISA)

Technical Skills:

Knowledge of regulatory laws (specific to industry)

Proficiency in auditing software and tools

Soft Skills:

Ethical judgment

Critical thinking

Industry-Specific Variations in the Compliance Auditor Role

The role of a Compliance Auditor is pivotal across various industries, each presenting unique challenges and regulatory frameworks that require specialized knowledge and skills. This section delves into how Compliance Auditors adapt their roles and responsibilities to meet the specific demands of the finance, technology, and healthcare sectors. By examining real-world scenarios, this analysis highlights the diverse skill sets needed to manage compliance effectively in different environments.

Finance Industry

In the finance sector, Compliance Auditors are essential in navigating a labyrinth of financial regulations, including anti-money laundering (AML) laws and various compliance standards. A pertinent case study involves a major bank that faced penalties for non-compliance with AML regulations. The Compliance Auditor’s role was critical in identifying lapses in the bank’s transaction monitoring processes. By implementing enhanced auditing techniques and training, the auditor helped the bank align with legal standards, thereby avoiding potential fines and reputational damage. This example underscores the auditor’s expertise in financial regulations and risk management, essential for maintaining integrity and legal compliance in the finance industry.

Technology Industry

Technology firms encounter unique compliance challenges, particularly concerning data privacy, cybersecurity, and intellectual property laws. For instance, a tech company grappling with data breaches benefited significantly from the intervention of a skilled Compliance Auditor. The auditor assessed the company’s cybersecurity protocols and identified vulnerabilities in their data encryption methods. Through a comprehensive audit and subsequent overhaul of security measures, the company strengthened its data protection practices, aligning with GDPR and other privacy regulations. This scenario illustrates the need for auditors in the tech industry to possess in-depth knowledge of cybersecurity and data protection laws.

Healthcare Industry

In healthcare, Compliance Auditors ensure that organizations adhere to patient safety standards, HIPAA regulations, and medical ethics. A notable scenario involved a hospital where compliance auditors played a crucial role in addressing issues related to patient privacy breaches. Through meticulous audits, the auditors identified several procedural deficiencies that led to unauthorized access to patient records. The auditors’ recommendations led to significant changes in the hospital’s access controls and staff training programs, thereby enhancing patient data protection and compliance with HIPAA. This example highlights the auditor’s role in promoting ethical practices and safeguarding patient rights in the healthcare sector.

Crafting the Perfect Job Description for a Compliance Auditor

Creating an effective job description for a Compliance Auditor is crucial in attracting the right talent and ensuring that the selected candidate is well-suited for the role’s demands within your organization. This section provides a comprehensive template and best practices designed to guide you in crafting a job description that is not only clear and detailed but also inclusive and appealing to a diverse pool of candidates.

Introduction to Job Description Components

A well-structured job description includes several key components:

Title: The job title should accurately reflect the level of seniority and area of specialization. It sets the tone for the role’s scope and the professional level expected of candidates.

Summary: A concise summary should encapsulate the role’s significance within the organization, providing a snapshot of the job’s main objectives and how it fits into the larger operational framework.

Duties: Clearly define the daily tasks and responsibilities. Specificity helps candidates understand what will be expected of them and assess whether they are a good fit for the role.

Qualifications: List the necessary educational backgrounds, certifications (like CIA or CISA), and professional experiences required for the position.

Skills: Describe the essential technical and soft skills needed, such as expertise in regulatory compliance, analytical thinking, and ethical judgment, which are crucial for optimal performance in the role.

Best Practices for Writing Job Descriptions

To create a job description that not only meets compliance requirements but also attracts highly qualified candidates, consider the following best practices:

Language: Use clear, professional, and unbiased language to ensure the job description is accessible and appealing to a broad audience. Avoid jargon and overly complex phrases that might deter potential applicants.

Inclusivity Practices: Emphasize the organization’s commitment to diversity and inclusion. Highlighting inclusivity can attract candidates from various backgrounds, enriching the organization’s culture and enhancing its compliance and ethical standards.

Interactive Element Introduction

This guide includes an interactive template tool that allows you to customize your job description effectively. By experimenting with different formulations and components, you can tailor the description to meet your organization’s specific needs and attract the right candidates. This tool simplifies the process and ensures that all essential elements are covered.

If you’re seeking the ultimate job description template for a Compliance Auditor—one that not only meets but exceeds industry standards—look no further. By clicking the link below, you’ll gain complimentary access to our premier job description template. This document is crafted with the precision and expertise characteristic of C9Staff’s renowned hiring methodology. It encapsulates the fundamental principles and best practices essential for recruiting top-tier talent in the field of compliance. Use this template as a robust foundation to tailor your hiring specifications, ensuring you attract and secure the best candidates for your organization.

Compliance Auditor Job Description Template

Download our Free Job Description Template

Salary Insights and Career Progression for Compliance Auditors

In the dynamic field of compliance auditing, understanding the salary ranges and career progression opportunities is crucial for both current and prospective employers. This section provides a detailed analysis of how geographical locations, industries, and experience levels influence compensation and career growth, aiding in strategic career planning and talent management.

Compliance Auditors’ salaries vary significantly based on geographic location, industry type, and years of experience. In general, auditors in metropolitan areas or regions with stringent regulatory requirements tend to earn higher salaries. For instance, Compliance Auditors in the financial sectors of New York or San Francisco can expect higher pay than those in smaller cities due to the complex regulatory environments and the cost of living in these areas. Entry-level positions may start in the lower percentile, but with advanced certifications and experience, salaries can double or even triple.

Graphical Representation

To illustrate these variations, the following graphs depict salary trends over the past five years across different regions and industries. Another set of visuals shows the correlation between years of experience and salary increments, providing a clear, quick reference that complements the textual data. These visuals help to underscore the significant impact of location and sector on potential earnings.

Career Progression Opportunities

The career path for Compliance Auditors typically starts at an entry-level position but can rapidly evolve into roles with greater responsibility and higher compensation, such as Compliance Manager or Director of Compliance. Advancement in this field requires a mix of technical expertise, thorough understanding of regulatory laws, and soft skills like ethical judgment and critical thinking. These roles often necessitate a proactive approach to continuous education and an ability to adapt to evolving compliance landscapes.

Future Roles and Possibilities

As regulatory environments become more complex, new positions are likely to emerge that require specialized knowledge in areas like digital privacy or international compliance standards. The future might see roles such as Digital Compliance Strategist or Global Compliance Consultant becoming crucial in organizations. These developments make it imperative for current professionals to engage in lifelong learning and professional development to remain competitive and effective in their roles.

If you’re ready to supercharge your career and land your dream job, C9Staff is here to guide you every step of the way. We invite you to click the link below and submit your resume to our talent acquisition department. If your qualifications align with our client requirements, we will reach out to discuss potential opportunities tailored to your expertise and career aspirations. Don’t miss the chance to connect with leading employers and elevate your professional journey with C9Staff.

Staying Current: Continuing Education and Professional Development in Compliance Auditing

In the rapidly evolving field of compliance auditing, the necessity for ongoing education and professional development cannot be overstated. As regulatory landscapes shift and new technologies emerge, Compliance Auditors must continually update their knowledge and skills to remain effective and relevant in their careers.

Introduction to the Importance of Continuing Education

For Compliance Auditors, staying abreast of the latest industry developments is crucial. The introduction of new digital privacy laws, adjustments to cross-border regulations, and other evolving compliance challenges require a commitment to continuous learning. This ongoing education ensures that auditors can effectively navigate complex regulatory environments and maintain their standing as experts in their field.

Opportunities for Professional Development

The field of compliance offers numerous opportunities for professional growth through various platforms and organizations. Conferences such as the International Compliance Association’s annual forum provide invaluable networking opportunities and insights into current compliance strategies. Additionally, seminars and courses, often offered by professional bodies like the Society of Corporate Compliance and Ethics, serve as vital resources for auditors seeking to enhance their skills. These events and resources are crucial for staying current with new practices and technologies influencing the industry.

Emerging Trends in Compliance

Recent trends in the compliance industry highlight the increasing importance of understanding digital transformations and global regulatory frameworks. The integration of artificial intelligence in compliance monitoring systems represents a significant shift, necessitating a deeper understanding of both technology and legal implications. Furthermore, as businesses become more global, compliance auditors must adapt to a broader range of international laws and regulations, emphasizing the need for a versatile and continually evolving skill set.

Benefits of Staying Current

The benefits of ongoing professional development in compliance auditing extend beyond mere knowledge expansion. They include enhanced career prospects through qualifications that keep pace with industry standards, improved job performance with up-to-date practices, and increased recognition within the professional community. Auditors who invest in their continuous education are often seen as valuable assets to their organizations, capable of leading their companies through complex compliance landscapes.

If you’re looking to enhance your recruitment strategy and find the perfect fit for a Compliance Auditor within your organization, C9Staff is here to assist. We invite you to click the link below and schedule a complimentary exploratory call with one of our expert account managers today. During this call, we’ll listen attentively to your specific needs and provide recommendations on potential candidates at no cost. This is your opportunity to assess the best talent available, ensuring you receive top-quality candidates at competitive prices. Let C9Staff help you streamline your hiring process and achieve optimal results.

Conclusion: The Strategic Value of a Well-Defined Compliance Auditor Role

As we conclude this guide on crafting the ultimate Compliance Auditor job description, it’s crucial to reflect on the strategic importance of this role within any organization. From the initial overview of the Compliance Auditor’s responsibilities to the detailed analysis of required skills and qualifications, each section has underscored the critical role these professionals play in maintaining organizational integrity and adhering to complex regulatory frameworks.

A well-crafted job description is not just a list of duties and requirements but a strategic tool that attracts qualified candidates who are capable of navigating the evolving landscape of compliance. The insights provided on qualifications, technical and soft skills, and industry-specific variations highlight the necessity of a meticulous approach in defining the role of a Compliance Auditor. These elements ensure that the organization not only meets its regulatory obligations but also thrives through enhanced compliance practices.

Employers are encouraged to take these insights into action. Utilize the structured templates and best practices outlined in this guide to refine your hiring processes. Proactively update and define the roles of your compliance team in response to new regulations and emerging trends, such as digital privacy and cross-border legislation, to stay ahead in the compliance game.

In closing, remember that the investment in defining clear and comprehensive job descriptions for Compliance Auditors will yield significant returns. Not only does it equip your organization to effectively manage compliance challenges, but it also fosters a culture of continuous improvement and professional development. This strategic approach ensures the long-term success and integrity of your organization in an increasingly regulated world.

By embracing these practices, your organization can transform its compliance function into a cornerstone of corporate success and sustainability.